Seize the opportunity invest with BBE

The world is swiftly transitioning to sustainable and renewable energy sources due to climate change and market forces. Battery and energy storage companies present an exceptional opportunity to capitalise on this shift. With solar energy and battery storage addressing the intermittency challenge of renewables, offering practicality, flexibility, and eco-friendliness, now is the ideal time to invest in the future of sustainable energy. Don’t miss out on this chance to establish a foothold in a rapidly expanding market.

Commitment to stakeholders

We are dedicated to creating value for our investors, supporting the communities we operate in, and safeguarding the environment for future generations. We partner with landlords of low energy-consuming industrial and commercial buildings, utilising existing infrastructure to avoid the need for new land development. This approach is cost-effective, quick to implement, and environmentally considerate. We install PV solar panels, batteries, and EV charging capabilities where appropriate. We have Heads of Terms Agreements with several landlords across the UK, offering lease rentals for the space used, thus providing greater value to landlords through annual rents and improving the attractiveness of real estate by providing sustainable, affordable power to tenants and EV charging.

The role of a security trustee for secured debt securities

Understanding the role of a security trustee is crucial when investing in secured debt securities like bonds or loan notes. Below is a detailed look at what a security trustee does and why their role is vital for a group of investors.

The Function of a Security Trustee: A security trustee is a corporate entity or person appointed to act on behalf of investors holding secured debt securities. The issuer, or borrower, receives funds from investors based on the terms of the instrument, which might include a charge over property, a debenture over company assets, or other forms of security. The security trustee holds these charges or debentures for the benefit of the investors and represents them without involving in the day-to-day operations of the company unless specified in the security trustee deed agreement.

Responsibilities of a Security Trustee: The primary duty of a security trustee is to act impartially while protecting the interests of the investors. If the borrower defaults, the security trustee can take action, such as appointing insolvency practitioners to manage the company’s assets, ensuring they are protected and managed for the benefit of the investors.

Having a security trustee offers significant advantages

Efficiency and Coordination: Provides a streamlined approach to enforcing the charge in the event of a default.

Cost-Effectiveness: Avoids the need for each bondholder to appoint their own legal representative

Simplicity for Borrowers: Simplifies dealings for the borrower, especially if there are changes in transaction terms or underlying assets. Administrative Ease: Handles administrative tasks like managing security interests when beneficiaries change, saving time and reducing complexity.

Investor Confidence: From the clients’ perspective, the investment is secured, which provides additional confidence in the project. The trustee effectively acts as the guardian of the investment, and if they are required to act, they can enforce the debenture and seek to recover such assets or value as possible, thereinafter distributing any value on a pari passu basis to all of the investors.

Debt-to-Equity Conversion: When the project is complete, the debt is converted into shares. This provides investors with equity in the project, aligning their interests with the long-term success of the venture.

Appointing a security trustee demonstrates Be Brighter Energy Limited’s commitment to their investors by providing an efficient, cost-effective, and coordinated means of managing secured debt securities. This approach protects investors’ interests and streamlines processes for the borrower, ensuring all parties benefit from a structured and professional approach to managing secured investments. Additionally, the conversion of debt into shares upon project completion.

Income forecast

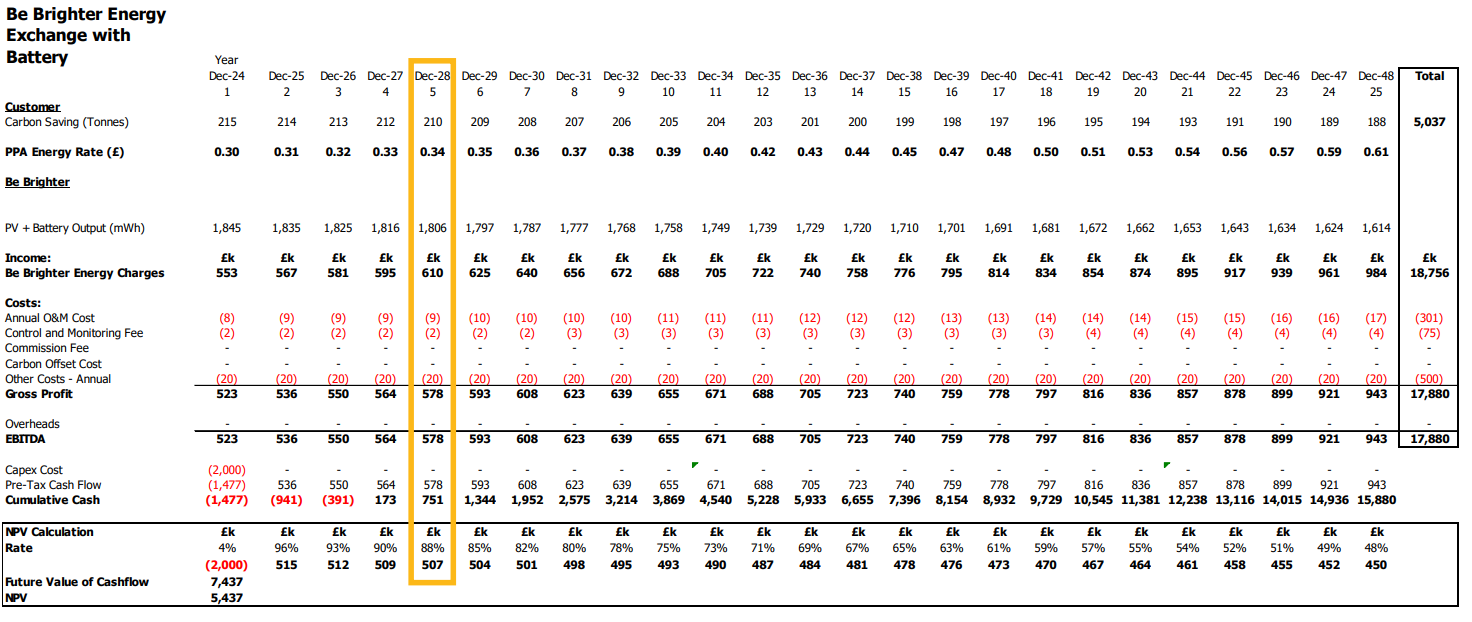

The table provides a detailed financial projection for our renewable energy project, showing increasing revenue and profitability over time with significant carbon savings. The initial investment is recovered within a few years, leading to substantial cumulative cash flow and a positive NPV, indicating a financially viable project.

Key to table and terms

NPV: Net Present Value (NPV) is a financial metric used to assess the profitability of an investment or project. It calculates the difference between the present value of expected cash inflows and outflows over a given period, using a specific discount rate. Within the shown table we can see in the first year, the initial £2,000,000 investment for the 1-megawatt solar project.

This includes fitting costs, solar PV panels and all the assets for a fully operation site. As shown in Year 2, there is positive cashflow as the site has been producing energy for a year. It shows total cash generation of £17.8m (measured as EBITDA) over the 25 year period.

We have assumed a cost of money of 4%, which reduces the current value of the returns over 25 years to be £7.437m (in today’s terms), delivering a positive NPV of £5.437m

O&M Cost: Operation and maintenance (O&M Costs) costs for solar photovoltaic (PV) systems encompass the ongoing expenses necessary to ensure efficient and reliable performance over the system’s lifetime. Key components include remote monitoring and performance analysis to track system efficiency, routine inspections and cleaning to maintain panel effectiveness, and preventive and corrective maintenance for system components such as inverters and wiring.

Administrative costs cover insurance and permits, while long-term replacement costs account for parts with limited lifespans. Labour costs involve wages for skilled technicians and training expenses. Additional costs may include utility fees and security measures.

Factors such as system size, location, and technology can influence O&M Costs. These expenditures are crucial for maximsing the return on investment by ensuring the solar PV system operates safely and efficiently throughout its operational life.

PV: PV stands for photovoltaic, which refers to the technology used to convert sunlight directly into electricity using semiconductor materials, typically silicon. When sunlight hits the PV cells, it generates an electric current through the photovoltaic effect. PV systems are commonly used in solar panels for generating renewable energy.

Carbon Saving: Carbon saving refers to reducing carbon dioxide (CO₂) emissions through practices that minimise fossil fuel use. This includes using renewable energy sources like solar and wind. For example, our 1 megawatt site saves a total 5,037,000 tonnes of carbon over a 25 year period.

PPA: A power purchase agreement (PPA) is a contractual arrangement between a power producer and a buyer, usually a utility company or large-scale energy consumer. Under a PPA, the power producer agrees to supply electricity generated from a renewable energy source, such as a solar, at a predetermined price for a specified period. The buyer, in turn, commits to purchasing the electricity generated.

PPAs provide financial stability for the power producer by guaranteeing a longterm revenue stream and offer the buyer a stable supply of renewable energy, often at a lower and predictable cost compared to traditional energy sources. This arrangement is crucial for facilitating the financing and development of renewable energy projects. Within the shown example we have a PPA rate starting at £0.30 a kilowatt hour which assumes an annual increase of 3% per year.

PV + Battery Output: Combining photovoltaic (PV) systems with battery storage allows excess solar energy generated during the day to be stored for use during nighttime or cloudy periods. During daylight, PV panels convert sunlight into electricity, powering immediate needs and charging the battery with any surplus. At night or when solar output is low, the battery discharges the stored energy to meet demand.

This setup reduces reliance on the grid, lowers electricity costs, maximises the use of renewable energy, and enhances energy independence and sustainability. Within our example you can see our 1-megawatt solar site creates an output of 1,845,000 MwH a year.

What is a MwH: A megawatt (MW) is a unit of power equivalent to one million watts (1,000,000 watts). It is commonly used to measure the rate of energy transfer or production over time. One megawatt is equal to 1,000 kilowatts (kW).

Control and Monitoring Fee: The control and monitoring fee for a solar energy site covers the cost of overseeing and optimising the performance of the solar PV installation. This includes implementing and maintaining remote monitoring systems that track energy production, detect faults early, and optimise system efficiency.

Regular data analysis and reporting help in identifying trends and potential improvements, while proactive maintenance ensures minimal downtime and peak operational performance. This fee is crucial for maximising energy output, ensuring regulatory compliance, and maintaining the overall reliability of the solar energy system. This is shown in the example as a £75,000 over the 25 years.

Other Costs: Other costs associated with a solar energy site include site preparation, obtaining necessary regulatory approvals, interconnection fees to connect the system to the electrical grid, insurance coverage for equipment protection, financing fees, taxes, and depreciation.

These additional expenses are essential for ensuring the smooth operation, compliance, and longevity of the solar energy installation, contributing to its overall financial planning and sustainability. Within our example we have budgeted £500,000 for a 25-year period.

EBITDA: EBITDA stands for earnings before interest, taxes, depreciation, and Imortisation. It is a financial metric used to evaluate our company’s operational performance by excluding non-operating expenses like interest on debt, taxes, depreciation of assets, and amortisation of intangible assets.

EBITDA provides a clearer view of our company’s cash generation from core operations, making it useful for comparing the financial health of our company and assessing performance over time without the impact of financing decisions or accounting practices.

CAPEX Cost: CAPEX, short for capital expenditure, refers to the funds our company invests in acquiring, upgrading, or maintaining physical assets such as property, equipment, buildings, or infrastructure. These expenditures are typically significant and are intended to improve the productive capacity or efficiency of the business over the long term.

Tracking CAPEX helps our business manage cash flow, plan for future growth, and assess the return on investment from these capital assets. For example, our initial capital expenditure is £2,000,000 this is the total investment needed for a fully operational solar installation.

PV + Battery Output: Combining photovoltaic (PV) systems with battery storage allows excess solar energy generated during the day to be stored for use during nighttime or cloudy periods. During daylight, PV panels convert sunlight into electricity, powering immediate needs and charging the battery with any surplus. At night or when solar output is low, the battery discharges the stored energy to meet demand.

This setup reduces reliance on the grid, lowers electricity costs, maximises the use of renewable energy, and enhances energy independence and sustainability. Within our example you can see our 1-megawatt solar site creates an output of 1,845,000 MwH a year.

Pre Tax Cash Flow: Pre-tax cash flow refers to the amount of cash generated our business before deducting taxes. It represents the total cash inflows from operations, including revenues and other income, minus cash outflows such as operating expenses and capital expenditures, but before accounting for taxes.

This metric is used to evaluate the operational efficiency and financial performance of an entity, providing insights into its ability to generate cash before considering the impact of tax liabilities. In our example we have positive cash flow of £536,000 in December 2025 due to a full year of running our solar instiallation.

Cumulative Cash Flow: Cumulative cash flow represents the total amount of cash generated or expended over a period, typically from the inception of a project until the present time. It is calculated by summing up all cash inflows and outflows, including revenues, expenses, investments, and financing activities.

Cumulative cash flow provides a comprehensive view of the overall cash position and performance trajectory of an entity or project, helping stakeholders assess financial health, liquidity, and sustainability over time. In the shown table you can see our company has a positive cumulative cash flow in year 4.

NPV Rate: The NPV calculation rate is the discount rate used to assess the present value of future cash flows in net present value (NPV) calculations. It reflects the cost of capital or the minimum rate of return required by investors, adjusting for the time value of money to determine the profitability of an investment or project.

Future Values of Cashflow: Future values of cash flows refer to the projected monetary amounts that will be received or paid out at specific points in time beyond the present. These future cash flows can include revenues, expenses, investments or financing activities expected over a defined period.

Assessing future cash flows is crucial for financial planning and decision-making, helping businesses and investors anticipate income, expenses, and overall financial performance over time. Our total future values of cash flow is £7,437,000.

Please complete the form and we will send you our full information memorandum regarding the opportunity with Be Brighter Energy.